The moment your money lands in your bank account is always a beautiful ending note. The experience is even more memorable when everything goes smoothly, from the moment you open the withdrawal page to the message that your balance has changed. This article is a practical guide to withdrawing money at S666 Fast, safe and precise, with an emphasis on proper preparation, clean execution, transparent monitoring and skillful handling of situations. The goal is clear: to reduce the entire process to a few predictable touches, so that the fun is not interrupted by technical friction or emotional impatience.

Why speed must go hand in hand

Speed is a feeling, and sureness is a structure. A quick withdrawal request is only truly valuable when the verification system is coherent and your data is absolutely consistent. Good design always prioritizes safety first, then optimizes smoothness, because no one wants to “fast” and have to turn around because of a wrong character in the beneficiary field. Once the structure is tight, the rest is the art of reducing friction: enter less but enough, confirm clearly but not too long, transfer follows the optimal route and status feedback in real time. The feeling of immediacy therefore comes not from magic, but from a series of good decisions on both sides, the user and the platform.

Proper preparation saves half the journey.

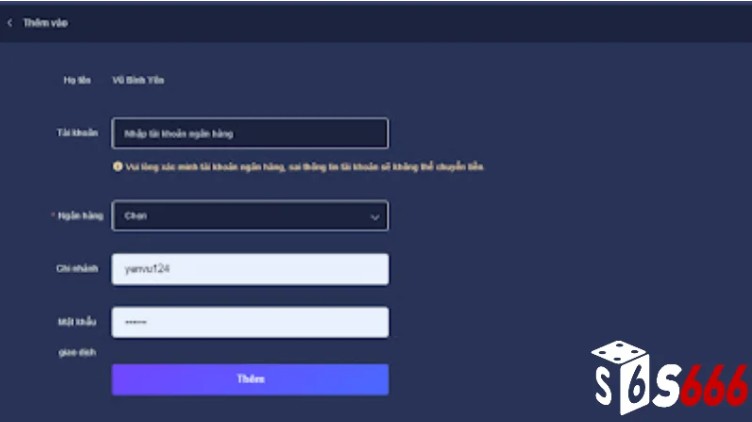

Before you start, you should review three core things: beneficiary information, connection, and authentication channel. The beneficiary information must match exactly with the data at the bank, including the account holder’s name in capital letters without accents, account number, bank name, and branch when necessary. Getting into the habit of saving a trusted beneficiary template will save you from having to retype it and reduce the risk of spelling mistakes. A stable connection is more important than bandwidth numbers, because the authentication and reconciliation flow needs to move at a steady pace. Dedicated Wi-Fi or a strong signal location will prevent the progress bar from stalling at the last minute. The authentication channel should be ready, especially if you use a time-based code generator. Syncing the device clock, checking the time zone, and ensuring the app is still working properly will help keep the code on track.

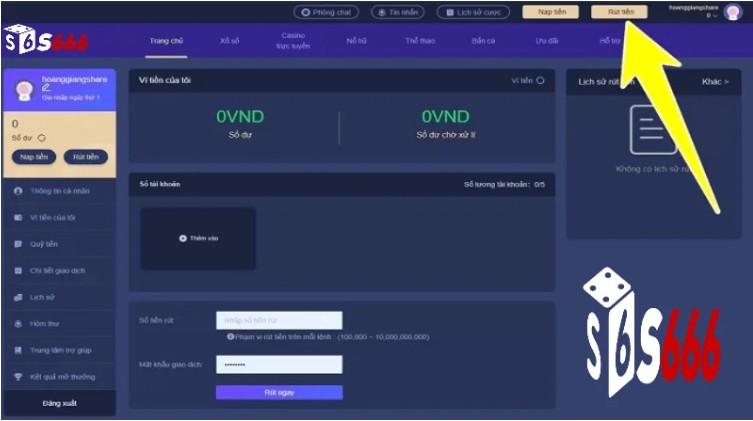

Clear operating framework, each step has a reason

You will go through four core moments including choosing the channel, entering the amount, confirming the beneficiary and verifying. Each moment has a clear goal, so just stick to that straight line, the instant speed will become very natural. When choosing a withdrawal channel, prioritize the fast interbank transfer if your bank supports it, because the time to display the money is often shortened during business hours. With linked e-wallets, make sure the linking status and identification are completed in advance to avoid hanging the request mid-way. When entering the amount, note the minimum, maximum and any fee incentives, if any, and keep a small balance on S666 if the platform requires it. A small tip for the reconciliation stage is to choose a round thousand number to make the statement easy to see.

The beneficiary confirmation section is the final check point. You read slowly for ten seconds, check the uppercase name without accents, account number and receiving bank. This step helps you catch any discrepancies before the money leaves the system. Immediately after is the verification layer. You should prioritize TOTP code generation applications to reduce dependence on SMS, which can be slow depending on the coverage area. Enter the code within the validity period, avoid pressing resend too quickly, causing the old code to be invalidated and then entering it by mistake. When the screen shows that it has been received, save the transaction code or take a photo; these are the “coordinates” for you to track the status and work with support when needed.

State transparency is an effective sedative

A three-tiered progress bar of received, reviewed, and transferred is enough to keep you from guessing. During business hours, requests typically move through these three tiers quickly; at night or on weekends, some banks may slow down slightly. The important thing is to always have something to look at, track, and reconcile. If you have an interbank reference code, write it down; it helps track when money has left the platform but hasn’t shown up in your banking app. In the meantime, don’t make the same request again just to be safe, as two duplicate requests can trigger the temporary lock protection, prolonging the process.

Multi-layered security, tightened in the right places to stay fast

Fast has never meant sloppy. The right layer of protection keeps you safe without getting in your way. Logins should come with two-factor authentication, and every major change like adding a new beneficiary, editing personal information, or enabling withdrawals to a new channel requires a stronger confirmation. Trusted device lists help speed up withdrawals on personal devices, but any logins from unfamiliar devices should be “softly blocked” with an additional authentication step. These tightening layers are like invisible seat belts: silent, but always there when you need them.

Personal data hygiene is also part of security. You don’t share your OTP code with anyone, even self-proclaimed “support staff”; don’t enter information from unfamiliar links; don’t save passwords on public computers. A weekly routine of reviewing your login logs and active session lists helps you spot irregularities early. If you see anything unusual, log out completely, change your password, check your 2FA method, and contact support with screenshots.

Handling common situations calmly

No system is immune to problems; the difference lies in your reflexes. When OTP via SMS is slow, check the signal, turn off the blocking of messages from unknown numbers, wait twenty to thirty seconds and then request again, or temporarily switch to the code generation application if available. When entering the wrong message many times, do not try to “type randomly” because it is easy to temporarily lock yourself; leave the screen for a minute, take a deep breath, then start the forgot password process or resynchronize the system clock.

If you accidentally enter the wrong beneficiary information and have just sent the command, contact the transaction code support immediately to request cancellation or correction. The intervention window is very short, so the habit of taking a screenshot immediately after the reception step is extremely useful. For the state of hanging beyond the normal threshold, do not describe the emotion, provide a clear context: withdrawal time, withdrawal channel, receiving bank, transaction code, device, application version. A short but sufficient description will help the team quickly localize and respond accurately.

Conclude

Rút tiền S666 Fast and safe is the sum of a series of small things in place. You prepare neatly, operate precisely, monitor transparently, handle situations calmly, and take responsibility for every decision. When those pieces fit together, from the order button to the notification of the money being returned, there are only a few breaths left. The curtain closes gently, you check a line in your notebook, smile because everything is as it should be, and then confidently move on to the next part of the day. The greatest joy is not just the number in your account, but the feeling of being proactive when you know where you are in the process, why that step is important, and what will happen next. Once you have that feeling, every subsequent withdrawal will be fast, accurate, and calm.